10 Roads

Across 9 states

3,400+

lane-kms

~INR 2,050 Cr

Gross Revenue (Toll Collection & Annuity Receipts, FY25)

ROFO Pipeline

11 HAM (Hybrid Annuity Mode) Assets (2,380 lane-km)

10 Roads

Across 9 states

3,400+

lane-kms

~INR 2,050 Cr

Gross Revenue

(Toll Collection & Annuity Receipts, FY25)

ROFO Pipeline

11 Hybrid Annuity Model Assets (~2,370 lane-km)

Overview

Citius TransNet Investment Trust (“Citius”) is focused on investing in a diversified portfolio of transport sector assets including road assets highways.

Citius is managed by EAAA TransInfra Managers Limited (“ETML”), part of the EAAA Alternatives platform. EAAA Alternatives operates a diversified, multi-strategy platform, in large, under-tapped and fast-growing alternative asset classes, focusing on providing income and yield solutions to a diverse client base, including, global pension funds, insurance companies and ultra-high net worth individuals. EAAA Alternatives is one of the leading alternatives platforms in India, in terms of assets under management with 15 years of experience and managed an AUM of ₹629.70 billion as of June 30, 2025.

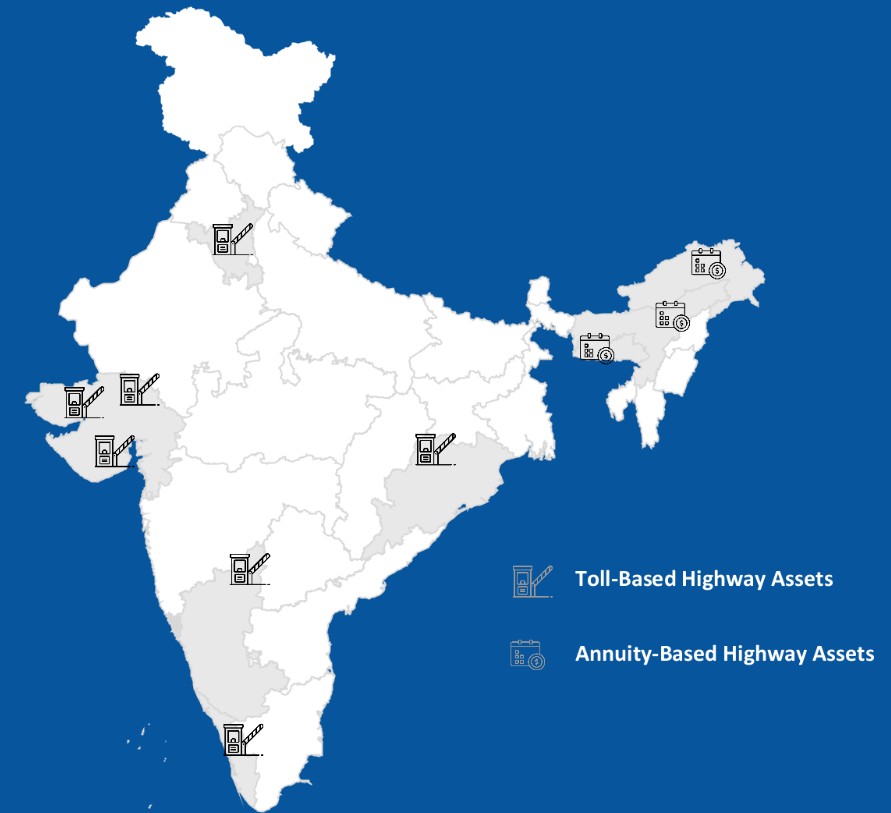

The initial portfolio includes 10 road assets—7 toll-based and 3 annuity-based—spanning 3,407 lane-kms.

Our Assets

We are a transport sector focused infrastructure investment trust, established with an objective to acquire, manage and invest in a portfolio of transport infrastructure assets, including roads, in India. We were settled by way of the Trust Deed, by the Sponsor, and registered as an InvIT with SEBI on August 1, 2025, in accordance with the provisions of the SEBI InvIT Regulations.

Upon completion of the Formation Transactions, we will have a large and dispersed initial portfolio comprising 10 Project SPVs, with a strong operational history, and supported by an operational team of 340+ people (including in the Project SPVs) as of June 30, 2025. Our Project SPVs totaling a length of 3,406.71 lane-kilometers, comprises seven toll assets spanning over 3,043.22 lane-kilometers, and three annuity assets spanning over 363.49 lane-kilometers, across nine Indian states.

Toll-Based Highway Assets are roads where users pay a toll to the Project SPV for use of the highway.

Annuity-Based Highway Assets – In this model the Concessioning Authority (in our case, NHAI / MoRTH) pays the Project SPV a fixed annuity semi-annually in lieu of construction & maintenance related investments & obligations undertaken by the Project SPV.

Key Strengths

Skilled & richly experienced management team

- A strong management with extensive and diverse expertise in the infrastructure and financial services sector

- Strong corporate finance and risk management practices of the Investment Manager & EAAA Platform

A large, well-dispersed & mature portfolio

- Toll assets with long operating history & proven track record of growth

- A mix of toll & annuity assets

Strategically located assets across geographically diverse clusters

- High quality assets with a revenue track record

- Presence in geographically diverse clusters & strong economic corridors

- Healthy mix of passenger & commercial traffic

- The commercial traffic diversified in terms of commodities & sectors

Strong pipeline of Identified ROFO Assets

- Right to make the first offer in respect 11 HAM assets under NHAI

- An aggregate lane-kms of 2,369.80 lane- kilometers (excluding service lanes) across 6 states.

De-risked, balanced portfolio

- A toll: annuity mix, potential for further balance with ROFO Assets

- High revenue contribution of commercial traffic

- Strong track record for annuity assets – timely receipt of full annuity amounts

Full spectrum asset management & maintenance capabilities

- The in-house asset management & expertise of the Project Manager

- Life-cycles based, technology driven approach

- Richly experienced 340+ member team of professionals

Attractive sector outlook with economic and social tailwinds

- Supportive policy frameworks

- Strong focus of the government on infrastructure investments & monetization

- Positive economic and structural factors in India that support passenger and commercial traffic growth

Differentiated asset acquisition & investment capabilities

- The EAAA Platform has an established track record of infrastructure assets acquisition

- Road assets acquired through multiple approaches – bilateral deals, distressed asset acquisitions, NCLT process

- Demonstrated ability to integrate acquired assets

- The platform, till date, has acquired 15 road assets from 5 distinct developers

Key Strengths

Skilled & richly experienced management team

A skilled and experienced management team focused on governance and capital efficiency

Robust Portfolio

A large, well-dispersed set of assets with long operating history, residual concession life, and proven traffic growth.

Strategic Locations

Strategically located assets across geographically diverse clusters, situated near major economic corridors

Strong ROFO Pipeline

Strong pipeline of Identified ROFO Assets – 11 HAM roads with NHAI as the counterparty.

Predictable Cash Flows

Stable cash flows from toll and annuity assets, with balanced traffic mix backed by industrial activity (commercial vehicle volume) and personal consumption activity (passenger vehicle volume) for toll assets and low counterparty risk for annuity assets

In-House Expertise

Full-spectrum asset management capabilities backed by technology-enabled operations and maintenance.

Differentiated M&A Capabilities

Proven ability to identify and execute value-enhancing acquisitions.

Platform Support

Backed by the EAAA platform’s strong track record in capital raising, AUM growth, and asset management.

Business Strategy

Disciplined Portfolio Expansion

Prudent Capital & Risk Management

Active Asset Management with Tech-Enabled O&M

Capability Building for Adjacent Opportunities in Transport & Roads